new mexico gross receipts tax due date

Filing statuses for gross receipts tax and their due dates are. Due Dates and Penalties.

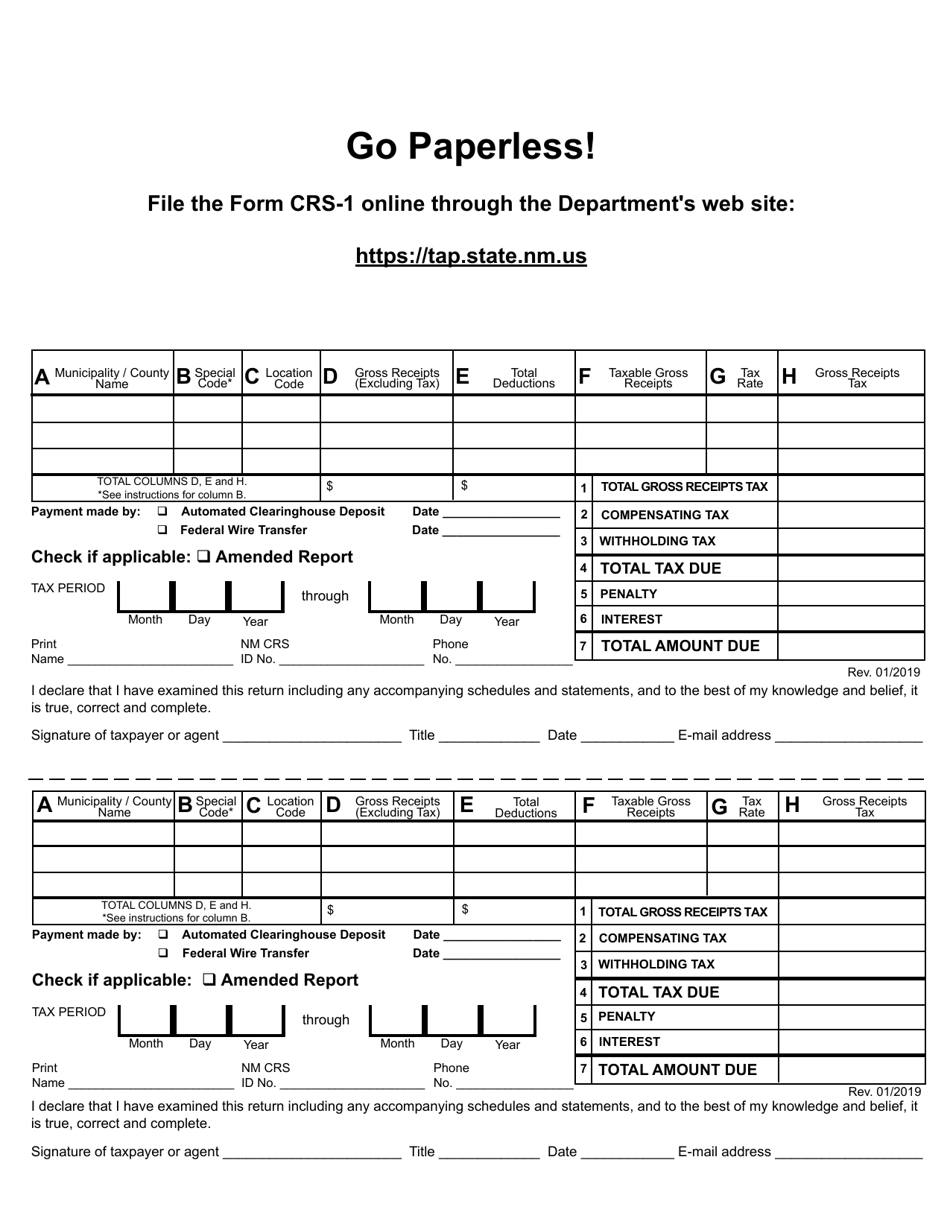

GROSS RECEIPTS TAX RETURN GENERAL INFORMATION This document provides instructions for the New Mexico Form TRD-41413 Gross Receipts Tax Return.

. 25th of month following end of report. For all CRS taxpayers the deadline for filing the CRS-1 Form online including remitting any tax due via electronic check or. Box 25128 Santa Fe New Mexico 87504-5128 Due date.

New mexico sales tax returns are generally always due the 25th day of the month following the reporting period. The tax is due on the 25th day of the month following the month of production unless otherwise authorized by the Department. Due Date Extended Due Date.

HISTORY OF 322 NMAC. There are two deadline requirements to consider. Q3 Jul - Sep October 25.

NM Taxation and Revenue Department PO. Q2 Apr - Jun July 25. Hearing scheduled April 29 on new Gross Receipts Tax regulations Department begins issuing special 600 rebates Appointments available at MVD due to expanded capacity.

Below weve grouped New Mexico gross receipts tax filing due. Tear at perforation and return bottom portion only to. Earlier today the Taxation and Revenue Department updated a key publication providing guidance on Gross Receipts Taxes GRT with new information on.

New Mexico sales tax returns are generally always due the 25th day of the month following the reporting period. Monthly the 25th of the following month if combined taxes average more than 200 per month or if you wish to. Personal income tax and corporate income tax.

Each Form TRD-41413 is. The governors initiative will comprise a statewide 025 percent reduction in the gross receipts tax rate lowering the statewide rate to 4875 percent. Hearing scheduled April 29 on new Gross Receipts Tax regulations Department begins issuing special 600 rebates Appointments available at MVD due to expanded capacity.

How to register for a gross receipts tax permit. The New Mexico TRD requires all gross receipts tax filing to be completed by the 25th day of the month following the tax period. Current through Register Vol.

Your New Mexico state gross receipt tax returns and payments. Q1 Jan - Mar April 25. 25th of month following end of report period.

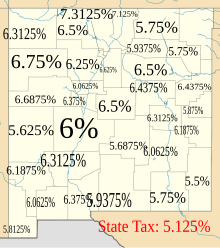

Hearing scheduled April 29 on new Gross Receipts Tax regulations Department begins issuing special 600 rebates Appointments available at MVD due to expanded capacity. In Las Cruces it would result in a gross receipts tax due of 931. The gross receipts tax rate varies throughout the state from 5125 to 94375.

New Mexicos gross receipts tax is admittedly confusing but the state still expects businesses to follow the law and pay what they owe from the sale of property or services. In a nutshell GRT is. All groups and messages.

BOR 67-2 NM Gross Receipts and Compensating Tax Regulations September. However we always suggest. 24 December 28 2021.

July 7 2021. This would be the first. Q4 Oct - Dec January 25.

New Mexico Increasing Tax On Services Changing Sourcing Rules

A Review Of New Mexico Tax Liability Options

How To File And Pay Sales Tax In New Mexico Taxvalet

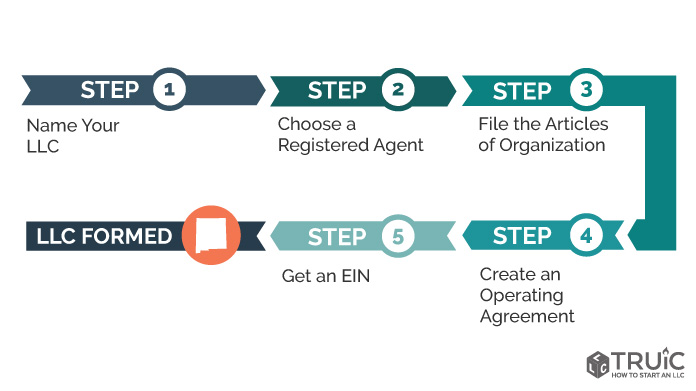

New Mexico Llc How To Start An Llc In New Mexico Truic

Home Taxation And Revenue New Mexico

How To File And Pay Sales Tax In New Mexico Taxvalet

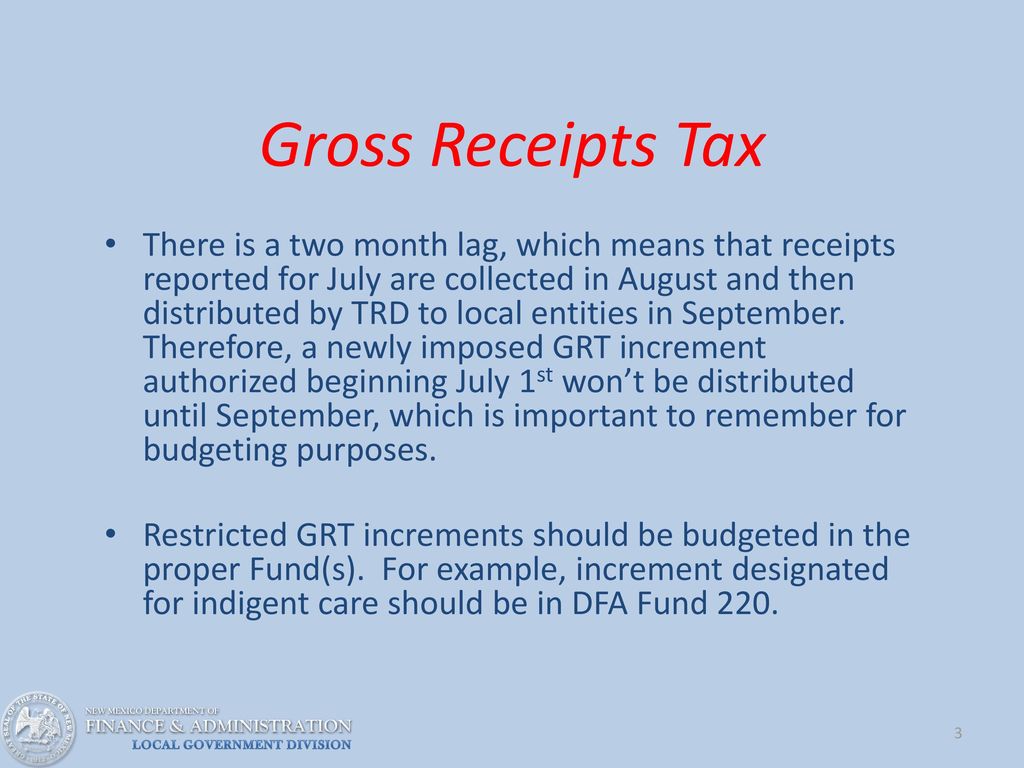

Gross Receipts And Property Tax Ppt Download

Gross Receipts And Property Tax Ppt Download

Gross Receipts And Property Tax Ppt Download

How To File And Pay Sales Tax In New Mexico Taxvalet

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

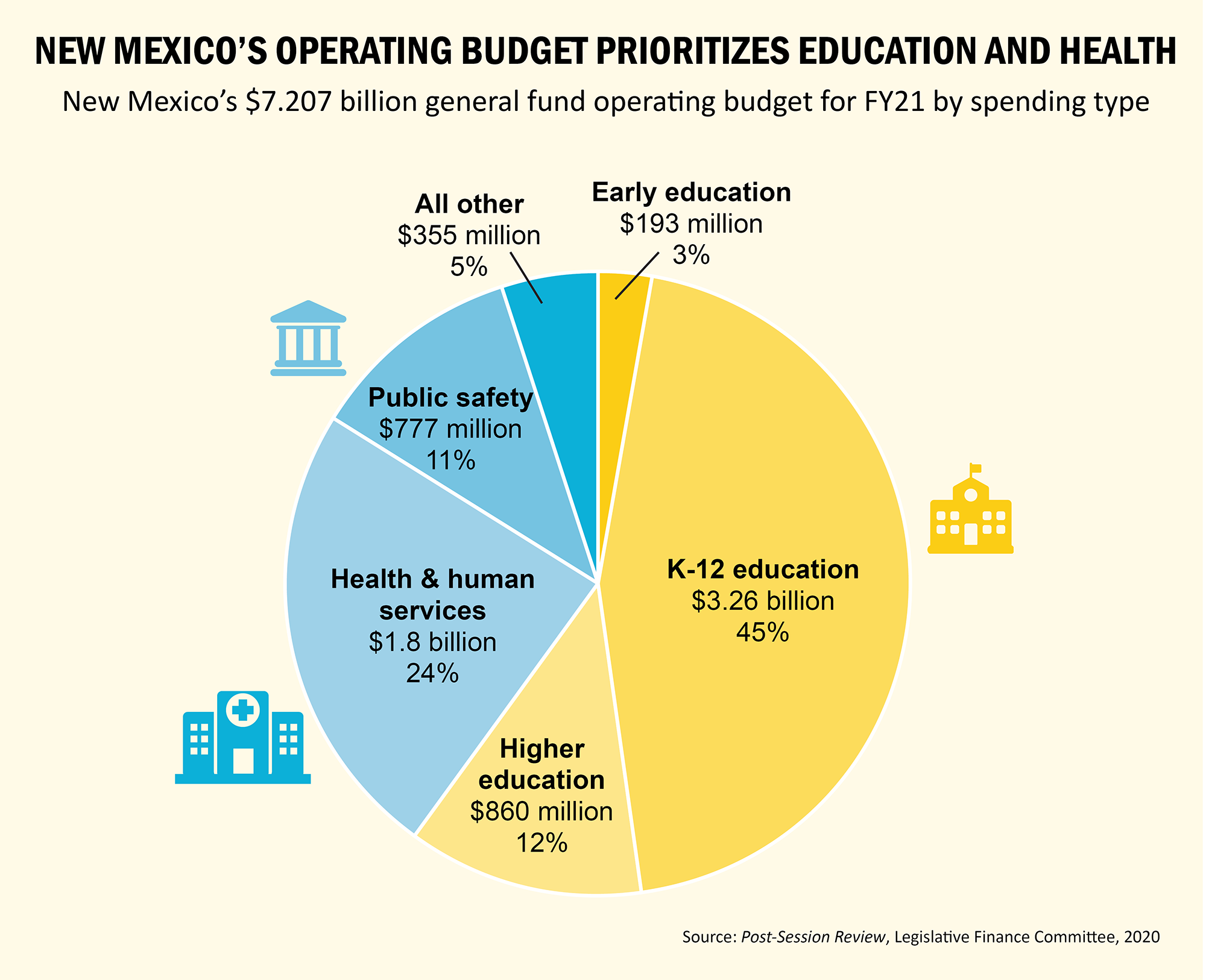

A Guide To New Mexico S State Budget New Mexico Voices For Children

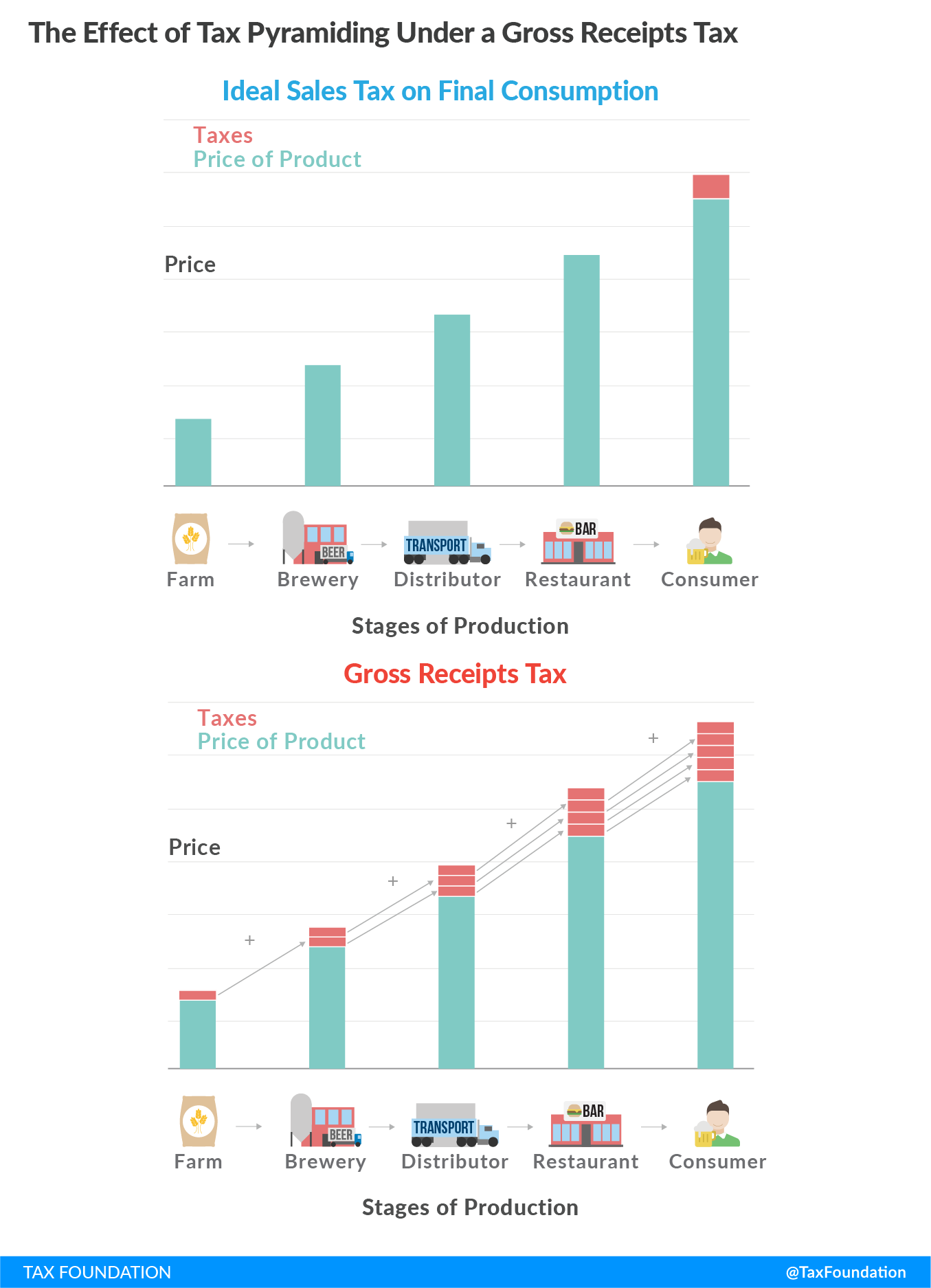

A Graphic Explainer Of Problems With New Mexico S Gross Receipts Tax Errors Of Enchantment

Home Taxation And Revenue New Mexico

New Mexico Retirement Tax Friendliness Smartasset

Form Crs 1 Download Printable Pdf Or Fill Online Combined Report Short Form For 3 Or Fewer Business New Mexico Templateroller

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors